Honeywell’s Quantum Computing Subsidiary, Quantinuum, Prepares for a $20 Billion IPO

Honeywell announced on Wednesday that Quantinuum, its majority-owned quantum computing subsidiary, has confidentially submitted draft registration papers to the U.S. Securities and Exchange Commission for an initial public offering (IPO). The deal is expected to value the company at an estimated $20 billion and could potentially raise around $1 billion.

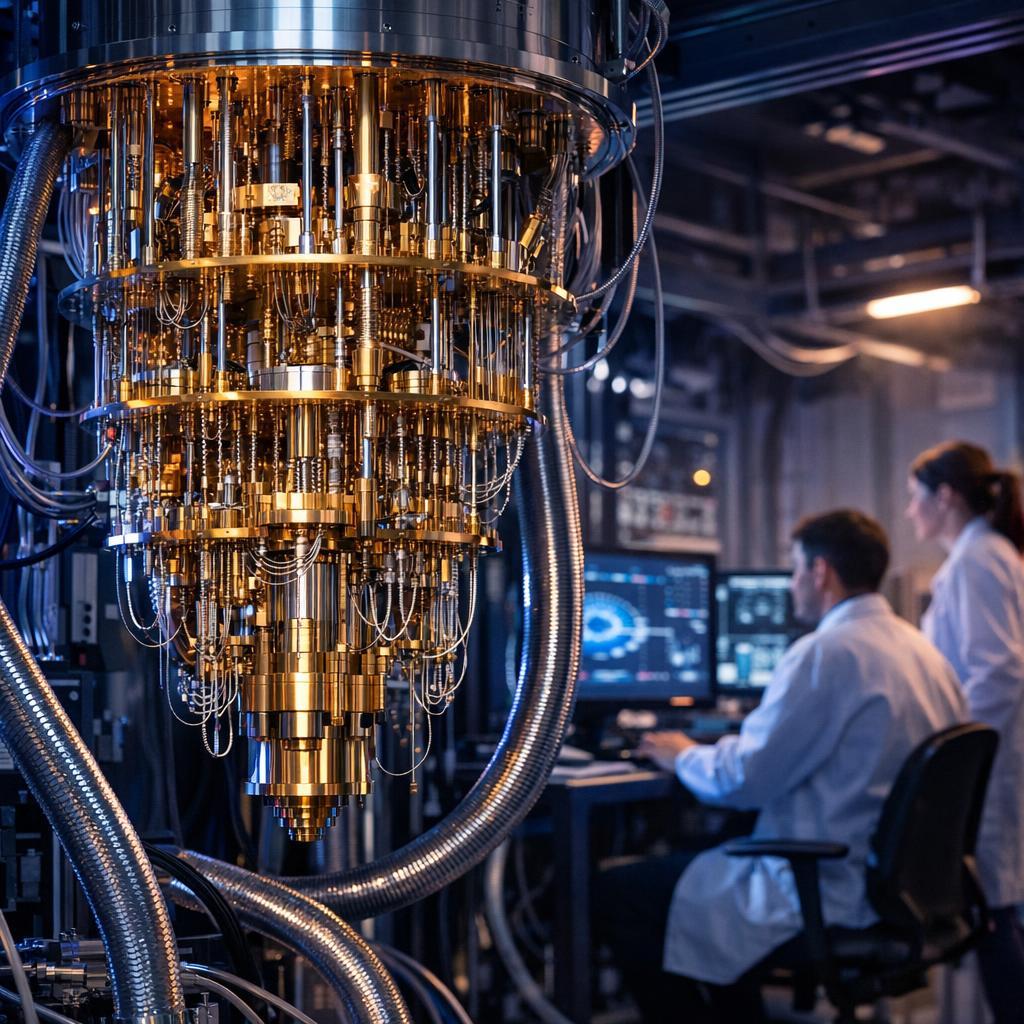

Established in 2021, Quantinuum is the result of a merger between Honeywell Quantum Solutions and Cambridge Quantum. The company has since emerged as a full-stack leader in quantum computing hardware, software, and cryptographic technologies. With a workforce of over 630 individuals, including more than 370 scientists and engineers, Quantinuum operates across facilities in the United States, United Kingdom, Germany, and Japan.

The potential IPO follows Quantinuum’s successful fundraising of approximately $600 million in September 2025, which valued the company at $10 billion pre-money. The round saw participation from investors such as NVentures (Nvidia’s venture capital arm), JPMorgan Chase, Mitsui, and Amgen. Major corporations like Airbus, BMW Group, HSBC, and JPMorgan Chase currently utilize the company’s technologies.

This move indicates a rising investor interest in frontier technologies and aligns with Honeywell’s wider portfolio restructuring strategy. The number of shares to be offered and the price range for the IPO have not been finalized yet. Industry experts consider this IPO a significant milestone for the quantum computing sector, which is poised to address complex challenges in fields like materials discovery, drug development, and cryptography.