Cerebras Systems Retracts IPO Filing Following $1.1B Funding Round

Cerebras Systems, a key player in the AI chip market, officially retracted its IPO filing on Friday. This move comes hot on the heels of the company securing a staggering $1.1 billion in funding, boosting its valuation to $8.1 billion. The AI chipmaker had initially filed for a Nasdaq listing in September 2024.

The company cited the need to update its prospectus with current financial and strategic information. This update is necessary to accurately reflect the company’s significant growth and recent developments.

CEO Andrew Feldman shed some light on the situation in a LinkedIn post. He stated that the original filing had become “stale” and no longer accurately represented the current state of the business.

- Cerebras achieved record revenues in 2024

- The company has attracted new investors such as Fidelity Management & Research Company and Atreides Management. These significant new players were not mentioned in the original filing.

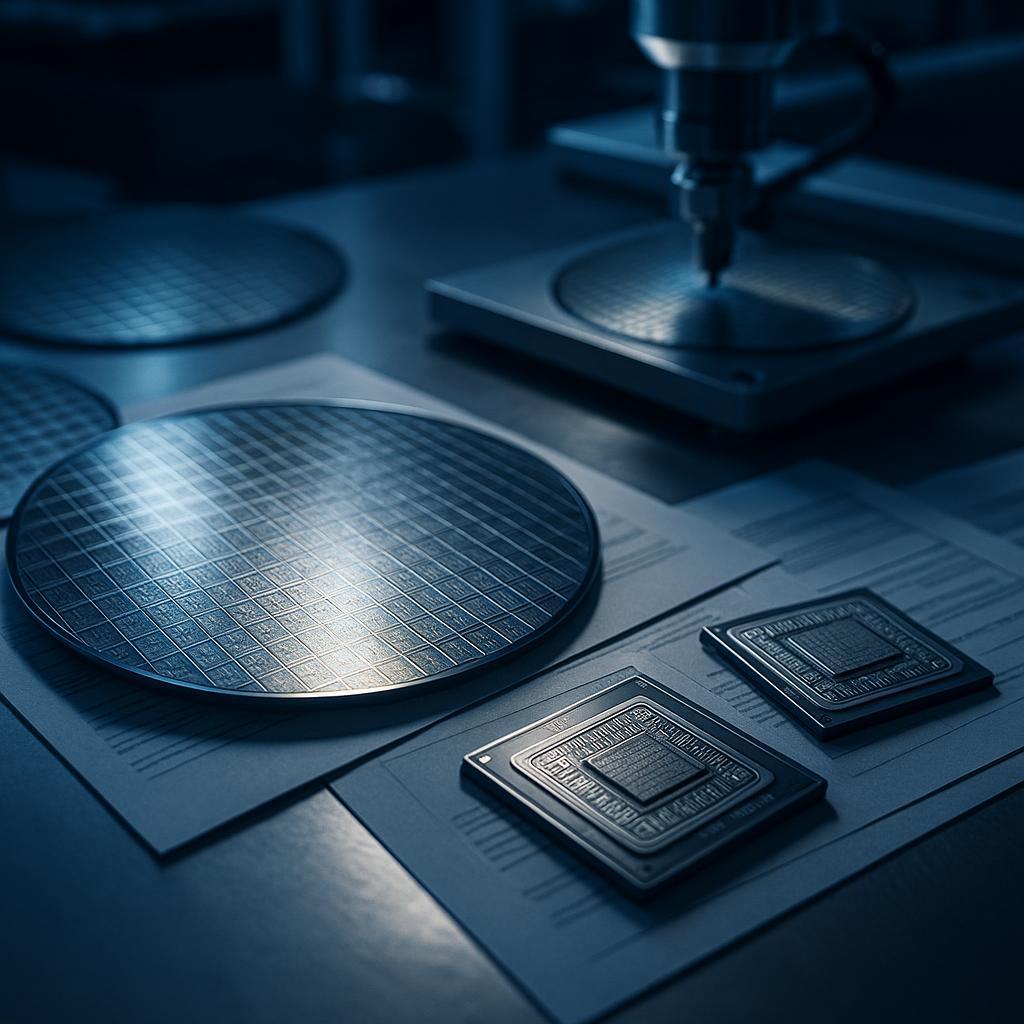

Cerebras, a direct competitor of Nvidia, specializes in the production of wafer-scale processors. These processors are designed to accelerate AI model training and inference. Despite the withdrawal of the IPO, the company maintains its intention to go public in the future.

A spokesperson told CNBC that the company plans to launch its IPO “as soon as possible“. This will be done with updated documentation that accurately reflects the current state of the company.